From the January 30, 2024 INK Top 20 Mining & Crypto Equities Report - The US dollar has enjoyed a rally of sorts over the past month, primarily on the back of a reassessment of the number of interest rate cuts the Federal Reserve is expected to deliver. Last fall, traders were betting on up to six rate cuts this year, but that has been revised to three because of stickier inflation, or so the story goes.

Ride image by Rusty Watson

In our view, there are circumstances at work that will impact Fed policy that extend well beyond the central bank's stated mandate of targeting 2% inflation or full employment. While the central bank will have to strive for those two mandates over the medium term, there are two new immediate objectives the Fed must achieve.

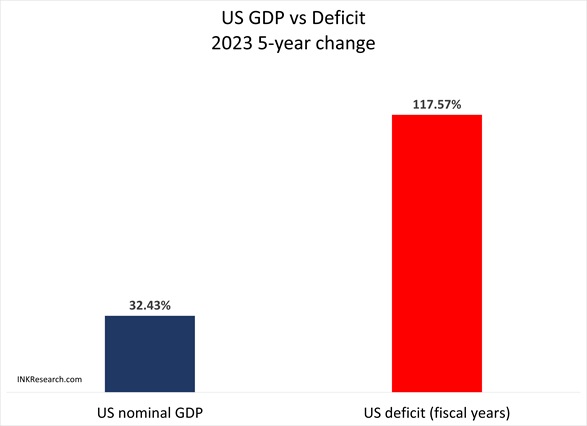

Those are banking system stability (an issue we started to address in this report in March), and Treasury market stability. The latter has become critical now that the US budget deficit appears to be structurally above 5% of GDP. In fact, the US economy now appears to be dependent on large government deficits to keep growing. Over the past five years, nominal US GDP has grown 32.4% (calendar years) while the government deficit has ballooned 117.57% (fiscal years). Last year, nominal GDP grew 6.3% while the US deficit grew 23.2%.

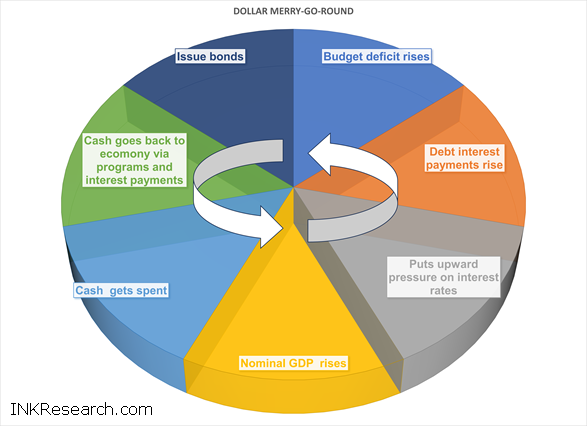

Washington is now running a grand experiment of modern monetary theory where the Treasury issues bonds to fill up its general account at the Fed. As that money gets dispersed into the economy via interest payments and programs such as social security and defence spending, it spurs nominal GDP growth. With nominal GDP rising, interest rates are supported at elevated nominal levels. Higher rates raise the cost of borrowing which forces Uncle Sam to issue more bonds. The cycle repeats.

While there may be a temptation to view high US interest rates as a sign of organic economic strength, we believe this is an illusion. Instead, high rates likely reflect the merry-go-round dynamic of the rising deficits that are fuelling nominal growth. Moreover, high real rates are likely starting to reflect fiscal dominance risk where Washington turns to higher inflation or yield curve control to finance deficits.

Meanwhile, as the cycle continues it generates two worrying byproducts. First, as interest payments begin to dominate program spending, those receiving the interest income will end up as relative winners. That will likely reignite concerns about inequality in society. Second, persistent high interest rates increase the risk that something in the financial system breaks.

The dollar merry-go-round has some big risks. We suspect the Fed will be forced to try to contain them by keeping rates low in order to slow down the cycle.

High US interest rates have attracted global investors to go for a US dollar ride. We suspect that, as the Fed eases monetary policy, it will encourage investors to get off. Alternatively, if the Fed drags its feet on cutting rates, as the cycle begins to spin faster and faster, we suspect more and more global players will decide to get off the merry-go-round and diversify into other currencies and precious metals. Either way, a weaker dollar would likely ensue which should generally benefit commodities and resource stocks.

Now that the bitcoin ETF story has played out, we will have to see if cryptocurrencies are able to achieve greater adoption as investors leave the dollar merry-go-round. This month, we see an encouraging sign that our five top-ranked crypto-equities all have either sunny or mostly sunny outlooks.

To view our Top 20 INK Edge ranked mining stocks and 5 top-ranked crypto-equities in this report, join us. Click here to learn about the benefits of membership including alerts and access to premium INK Research reports.

No Comments