From the February, 2024 INK Top 20 Mining & Crypto-equities Report - Next week, the hard rock mining industry will gather in Toronto for the annual Prospectors and Developers Association of Canada convention. We expect there may be a sense of frustration that many mining shares have not followed the gold price to new highs. Looking at the market-cap weighted mining benchmarks and ETFs, that does appear to be the case.

The February INK Top 20 Mining & Crypto-equities Report

However, if one looks in a different direction, there is a more optimistic picture.

Much of the frustration that afflicts the mining space is a result of an absence of institutions in the space. Canadian pension funds have pulled back significantly from the domestic public markets in favour of global private equity which lacks pricing transparency and, quite frankly, offers the managers some discretion in reporting their performance.

However, insurance companies, private investment funds, and hedge funds are a different matter. Many of these players still prefer and need the liquidity offered by the public markets. Because of their need for liquidity, their analysis tends to be grounded in benchmarks that are market weighted such as the S&P 500. Within such benchmarks, the mining industry is poorly represented. That means, if an investment manager decides to make a significant allocation to mining, he or she will be taking a significant amount of career risk as the performance is likely to be substantially different than the benchmark against which the manager is judged. It is all good if it works, but if the mining bets do not work out, managers could find themselves with some explaining to do. Many managers prefer to stick to the stocks in their benchmark and overweight the ones they like.

Yet, many ambitious managers are willing to make big off-benchmark bets to distinguish their performance from their peers. So, why are they not betting on mining? We expect the poor relative performance of the three biggest producers has a lot to do with it. Barrick Gold (ABX), Newmont (NEM), and Agnico Eagle Mines (AEM) are all trading below their 200-day moving averages. ABX and NEM are also down over the past year, and all three are down during the past three months.

The big three industry names will not make the screens of any momentum fund managers. Worse, because of their significant weight in market-cap weighted mining ETFs, the entire sector's performance reputation takes a hit due to sagging ETFs. For example, the iShares S&P/TSX Global Gold ETF (XGD) is down 10% over the past year.

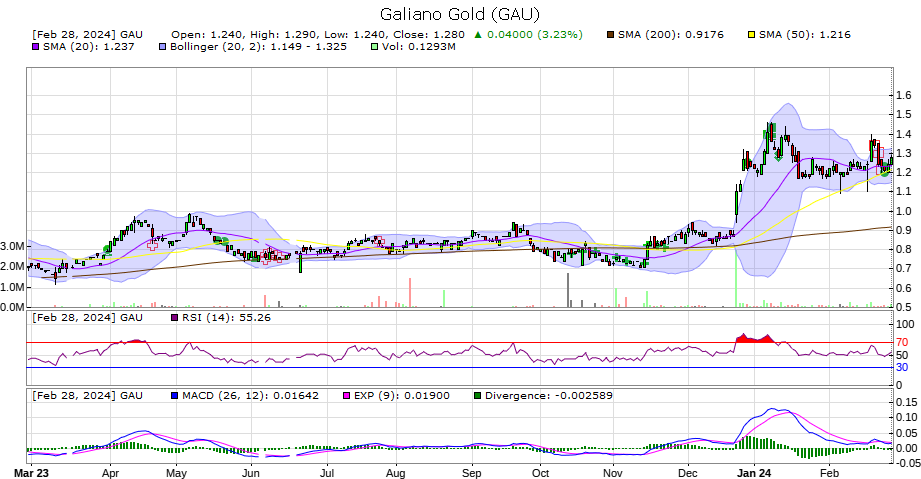

However, if institutions were to look beyond the big three and the market-cap weighted mining ETFs, they could find some big winners in the mining space. The winners include producers, near producers, and juniors. For example, in our Top 20 this month, producer Galiano Gold (GAU) is not only trading above its 200-day moving average but is also up 80% over the past year and 45% over the past three months.

In fact, in this month's INK Top 20 Mining list, 15 stocks are trading above their 200-day moving averages and are also up over the past 3 and 12-month periods. There are mining plays for momentum fund managers to consider, but they have to look beyond market-cap benchmarks and ETF products.

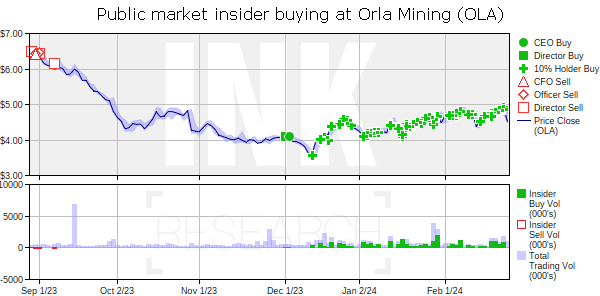

We will end our mining discussion with a final note of optimism for mining investors. We are starting to see some encouraging signs on the institutional front. As we have been reporting over the past few months in our Money is Moving feature on inkresearch.com and Canadianinsider.com, insurer and contrarian investor Fairfax Financial (FFH) has been buying Orla Mining (ORLA) which has a mining asset in Panama. Fairfax made its first reported ORLA purchase on December 12th at $3.55. The stock has since advanced 24%.

Bitcoin has been breaking out on investor speculation surrounding the network's expected halving of mining rewards in April. That has helped to reinvigorate the digital asset space. This month, crypto-exchange consolidator WonderFi Technologies (WNDR) moves up INK's crypto-equity rankings to challenge digital deposit innovator VersaBank (VBNK) which holds on to the top spot.

- This is an excerpt from the February INK Edge Top 20 Mining & Crypto Equities Report. The entire report including the 20-top ranked INK Edge mining stocks and 5-top crypto-equities is available for members of inkresearch.com and Canadianinsider.com. If you are not a member, use code LOOK24 to save $185 off your first year Canadian Insider Ultra Club membership. That means you can join us for $315 plus tax in your first year. Easily cancel anytime to stop your future renewals. Use coupon LOOK24 until March 5th at which point the offer ends.

INK Edge outlook ranking categories (Sunny, Mostly Sunny, Mixed, Cloudy, Rainy) are designed to identify groups of stocks that have the potential to out or underperform the market. However, any individual stock could surprise on the up or downside. As such, outlook categories are not meant to be stock-specific recommendations. For background on our INK Edge outlook, please visit our FAQ#3 at inkresearch.com. This is not investment advice.

The February Top 20 Mining and Top 5 Crypto-equities stock lists were generated based on INK Edge V.I.P. outlook rankings as of February 27, 2024. Photo by Japheth Mast.

No Comments