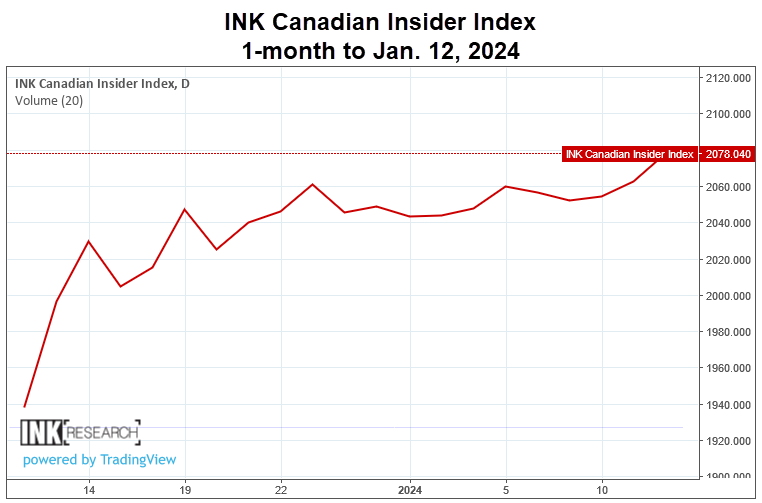

So far, Canadian stocks are helping investors navigate the risky waters of 2024. The INK Canadian Insider Index advanced 0.9% last week, leaving it up 1.4% in the new year. The gains took place despite a rough start for big Basic Materials stocks with the S&P/TSX Capped Materials Index down 2.0% for the year. In a notable divergence, the S&P/TSX Venture Index, which is a proxy for junior mining, has advanced 0.6% year-to-date.

The INK Canadian Insider Index is leading in early 2024 (click for larger)

Retail investors appear more optimistic than institutions about the prospects for mining and other materials names.

Given the elevated level of the INK Basic Materials Sentiment Indicator at 263%, we suspect retail may be on to something. At that indicator level, there are slightly more than 2.5 stocks with key insider buying for every one stock with key insider selling over the past 60 days.

Moreover, gold stocks may finally be starting to recognize the fact that gold is trading near all-time highs. Gold stocks jumped on Friday, helping to pull the INK CIN Index higher. The top index gainer last week was IAMGold (Mixed; IMG), up 10.1%, followed by package maker Cascades (Sunny; CAS), up 9.7%, and Morguard (Sunny; MRC), up 6.2%.

The INK CIN Index's advance has taken place even as oil & gas stocks gave back some of the previous week's gains. The biggest Index laggards last week were Baytex Energy (Mostly Sunny; BTE), down 5.8%, Tamarack Valley Energy (Mostly Sunny; TVE), down 4.4%, and Kelt Exploration (Mostly Sunny; KEL), down 3.9%.

Uranium has had no such pullback, with the Sprott Physical Uranium Trust (U.UN) hitting new highs on Friday. That put a spark under uranium juniors and nuclear-power industry providers such as INK CIN Index member Aecon Group (Sunny; ARE) which advanced 0.9% on Friday.

Geopolitical developments are currently taking place with potentially significant economic consequences. In particular, attacks on ships in the Red Sea have already put pressure on supply chains. If the Middle East conflict drags on, there could be a growing incentive to hoard commodities. Such a scenario may leave resource stocks as one of the few places to hide in a politically volatile year.

To read the full report January 15, 2024 Market INK Report which includes a list of the Canadian stocks with the most insider buying and selling over the past 60 days, members please click here. If you are not a member, take advantage of our January sale and join us today. Learn more here.

INK Edge outlook ranking categories (Sunny, Mostly Sunny, Mixed, Cloudy, Rainy) are designed to identify groups of stocks that have the potential to out or underperform the market. However, any individual stock could surprise on the up or downside. As such, outlook categories are not meant to be stock-specific recommendations. For background on our INK Edge outlook, please visit our FAQ#3 at INKResearch.com.

No Comments