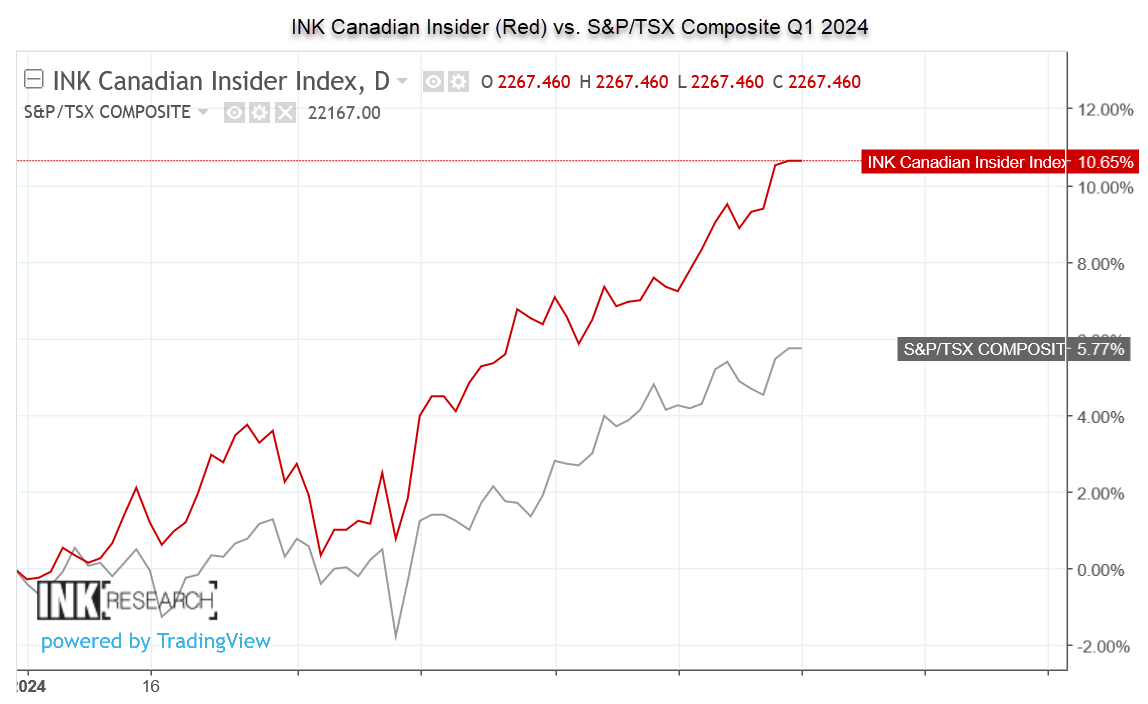

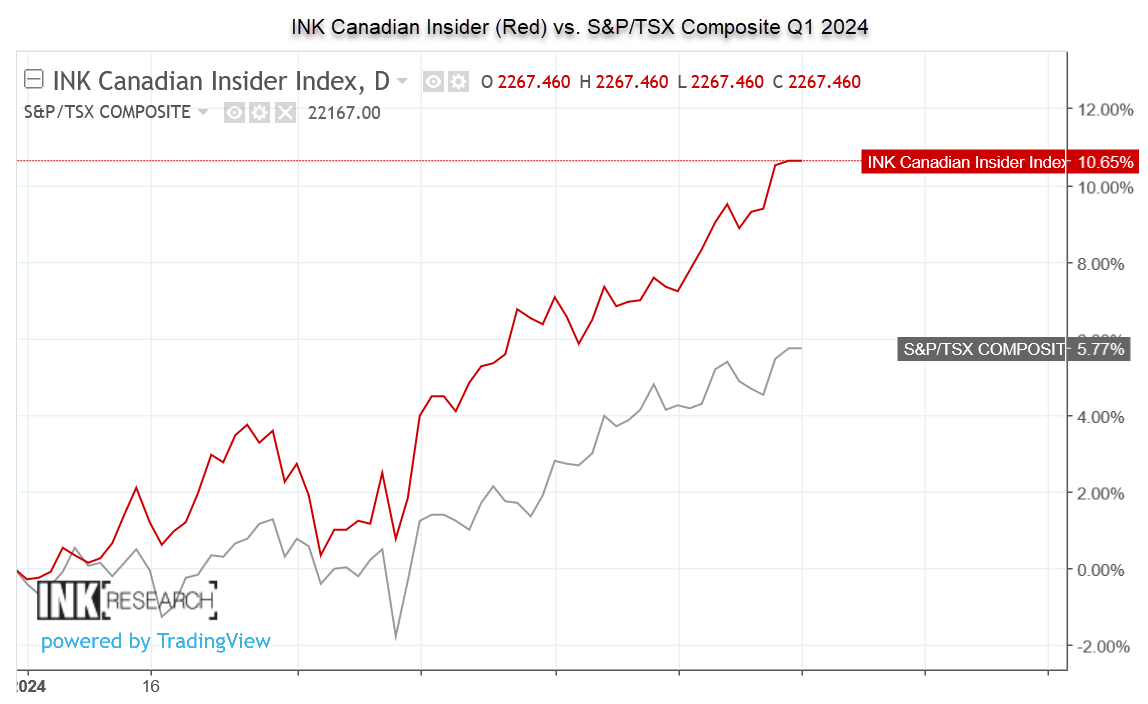

From the April 1, 2024 Market INK Report - The INK Canadian (CIN) Insider Index which tracks 50 stocks on the TSX preferred by insiders advanced 10.65% in the first quarter of the year, outperforming the S&P/TSX Composite Index by 4.88% during the period. Since going live on November 14, 2014, the INK CIN Index is up 126.75% versus 49.99% for the TSX Composite Index on a price basis.

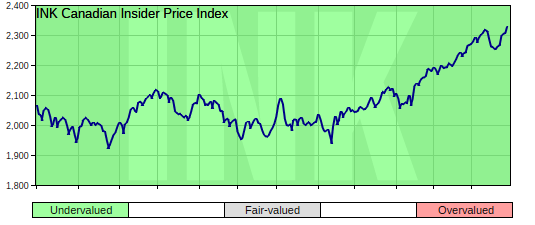

The INK Canadian Insider Index tracks 50 stocks listed on the TSX preferred by insiders

Despite this substantial outperformance, legacy media, without exception, ignores the INK CIN Index, preferring to play it safe by exclusively quoting the S&P/TSX Composite despite its lacklustre performance. However, the way we see it, this is a bit of a blessing for those who use insider activity and holdings in their investment decision-making.