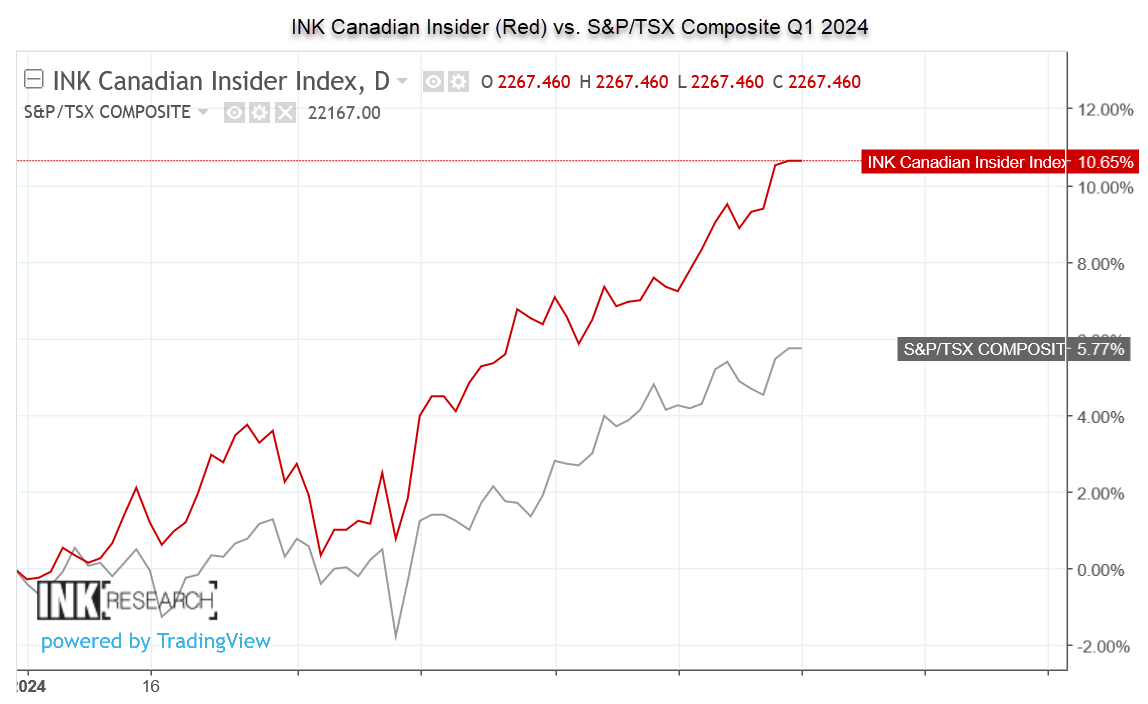

From the April 1, 2024 Market INK Report - The INK Canadian (CIN) Insider Index which tracks 50 stocks on the TSX preferred by insiders advanced 10.65% in the first quarter of the year, outperforming the S&P/TSX Composite Index by 4.88% during the period. Since going live on November 14, 2014, the INK CIN Index is up 126.75% versus 49.99% for the TSX Composite Index on a price basis.

The INK Canadian Insider Index tracks 50 stocks listed on the TSX preferred by insiders

Despite this substantial outperformance, legacy media, without exception, ignores the INK CIN Index, preferring to play it safe by exclusively quoting the S&P/TSX Composite despite its lacklustre performance. However, the way we see it, this is a bit of a blessing for those who use insider activity and holdings in their investment decision-making.

The bias against the INK CIN Index helps to keep the importance of insider commitment off the radar screens of many investors while at the same time, the media overemphasize company size as an investing factor. For more on how INK incorporates insider commitment into the INK CIN Index, watch the short video on the INK Edge process in our FAQ on inkresearch.com.

The INK CIN Index's Q1 performance was led by the energy sector which advanced 17.79% as tracked by the S&P/TSX Capped Energy Index. Insider sentiment remains supportive of both the broad Canadian market and the energy sector. As of March 28th, the INK Indicator, which tracks insider sentiment, stands at 97.5% while the INK Canadian Energy Indicator is at 100%. Any reading under 100% means there are more stocks with insider key selling than there are with key insider buying over the past 60 days. In both cases, the indicators are near 100% which is a positive situation given the rally in stocks seen in the first quarter.

As stocks rally, we expect insider sentiment to drop as insiders take profits. At the early stages of a bull market, this is a positive sign as it confirms there is positive price momentum. At later stages, sliding sentiment can be a warning sign, but we are not there yet.

In terms of oil & gas, we see a number of positive factors supporting the group. First, we continue to be in a strong seasonal period. Secondly, OPEC+ production cuts may finally be starting to have an impact on global prices, and we expect this trend could continue as we move through the election season. Finally, there are some signs from recent EIA field data that US crude production may have peaked for the time being which would be supportive of both crude and natural gas prices if this turns out to be a trend.

Canadian Insider Ultra Club mrembers can read the full report via the INK PDF Reports section on this website. If you are not a member, join now for full access. Learn more here and join.

No Comments