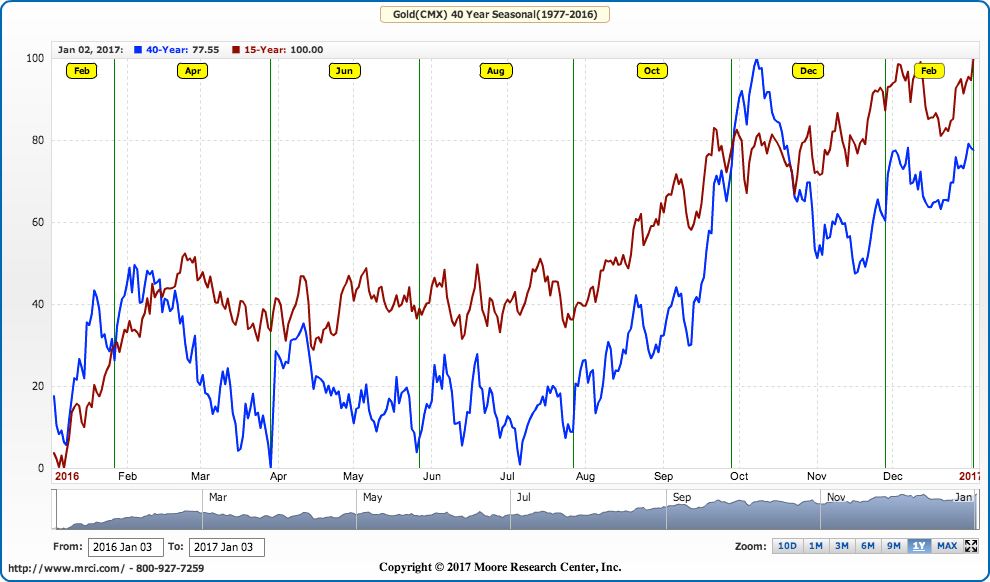

For those investors lamenting gold stocks for their being stuck in the mud for several months, it should come as a relief that we are now moving into the most bullish seasonal time of the year for gold. This 40-year seasonal gold chart shows that gold often sees final weakness just before August begins and then begins a torrid run of 8 to 10 weeks into October.

This summer rally scenario is all the more likely this time around since investor sentiment is very poor. One measure, The Bullish Percent Gold Miners Index indicates only 21% of gold stocks are in an uptrend.

Even more compelling is the fact that large institutions that trade precious metals have cut their short positions to extreme low levels seen in January 2016 when gold began a rise of $200 and mining stocks soared.

What's more, I am forecasting a powerful rally in speculative stocks across a number of sectors in the weeks ahead and that spirit of speculation should strongly benefit silver.

With that in mind, here are a few quality mining stocks that are candidates to outperform once gold and silver break out.

Avino Silver & Gold Mines (ASM) is a Mexican silver miner I've mentioned a number of times before in my blog. The company is looking to ramp up production from 3 million silver equivalent ounces to 4 million silver equivalent ounces in the next year or so. But what may be responsible for the stock's strong outperformance of the sector is that this small, well-managed company expects to begin gold production at their Bralorne Gold Mine in BC by year end. And it's there that they are aggressively ramping up from 20-30,000 ounces of gold per year, to well over 100,000 ounces of gold within 4-5 years. What's more, they are the lowest cost silver producer I can find, at $10.34 (AISC). Insiders reflect the outlook of the company and they’ve been heavy buyers, adding over $760,000 worth of shares this year. And CEO David Wolfin has added half of those shares. Avino has been a huge winner for our Hedgehog Trader Newsletter readers and I expect this will continue in the months ahead.

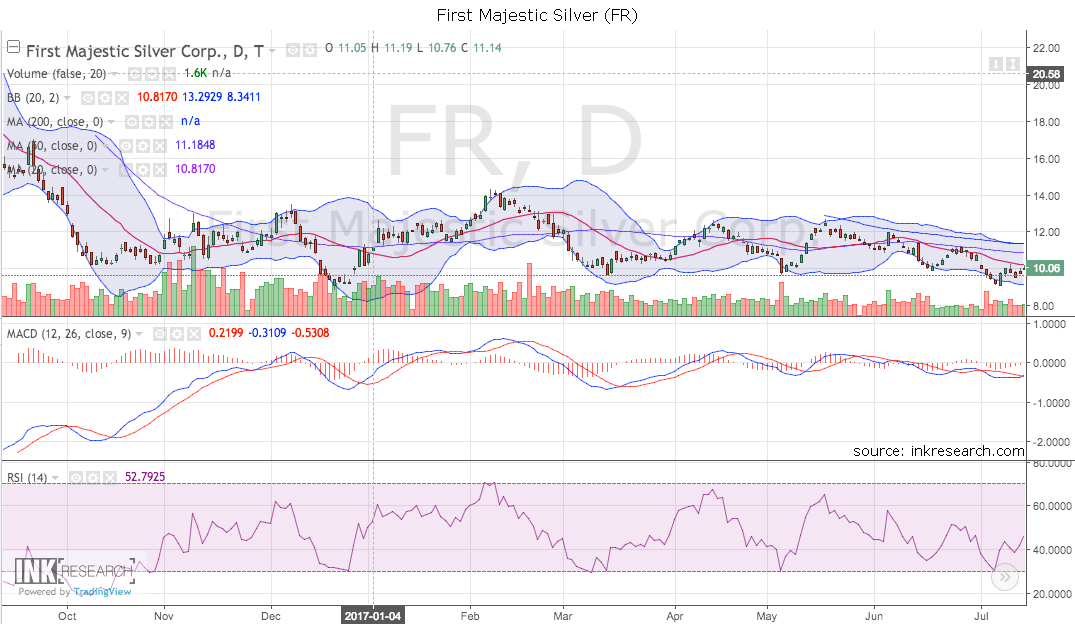

First Majestic Silver (FR) is the purest silver producer there is, generating 13 million ounces of silver per year, making up 70% of their revenues, and, according to the company, soon to be 80%. If you are a long-term silver bull, First Majestic should be considered as a core position in your portfolio. Insiders have sold net $5 million worth of stock this year but still hold 4%. Hedgehog Trader Newsletter added shares near its June lows.

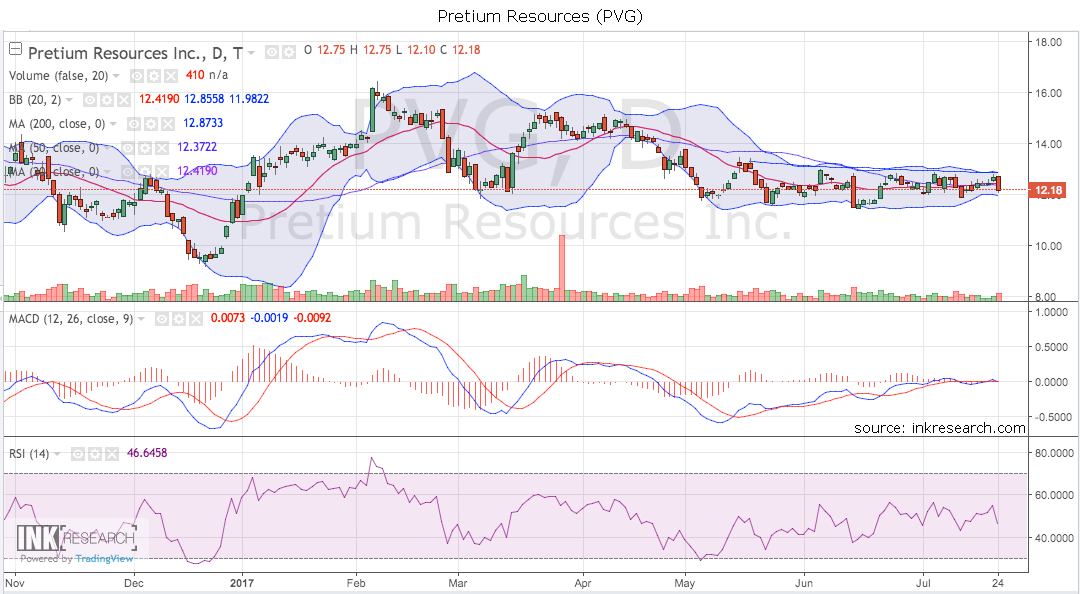

Pretium Resources (PVG) should impress gold stock investors. Not only have they just begun commercial production at their Brucejack Mine in BC, but they have done so well ahead of schedule. With the miner looking forward to producing 500,000 ounces of gold per year, there's a big M&A bullseye on their back. And that spells tremendous upside once gold finally breaks out. Furthermore, 4 insiders have bought nearly 25,000 shares since May 12th. Insiders bullishly own nearly 20% of the company’s shares.

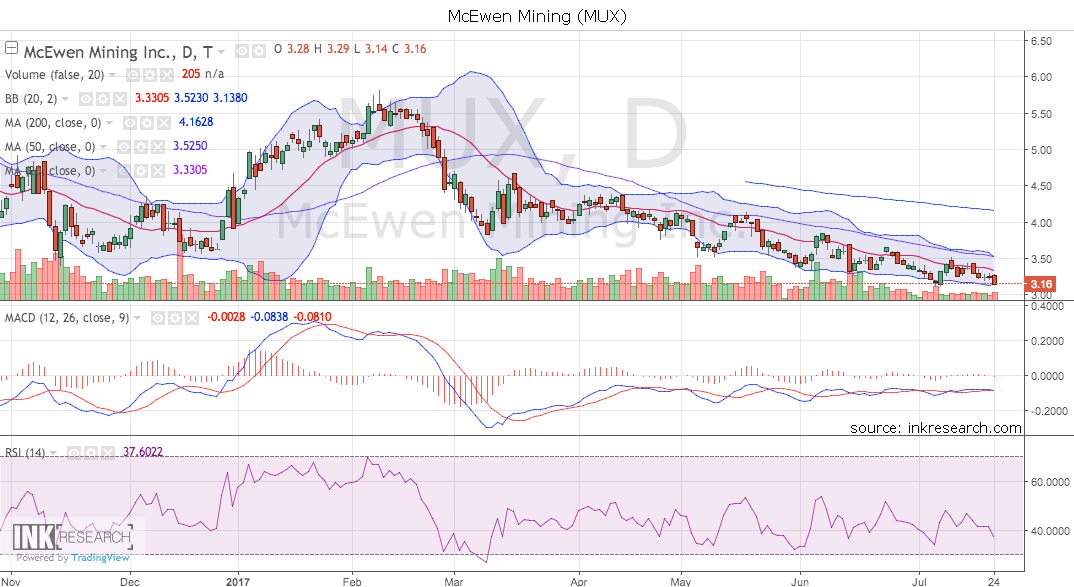

Even though the gold miner has underperformed for some time, one should never count out storied mine builder Rob McEwen and his Mexican miner McEwen Mining (MUX). Indeed, while his company is focused on ramping up gold and silver production, one aspect of the company has been overlooked by investors: the continued development of a monster copper project in Argentina called Los Azules. Its resource sits at 19 billion pounds (and growing). Now, with copper's price soaring higher and higher (as I have forecast in past blogs) the potential for a sale in the neighbourhood of $300 to $400 million grows ever stronger. That is no chump change as the mining company itself has a market cap of just under $800 million. In addition, McEwen famously does not take a salary but owns 25% of the miner, so his goals are clearly aligned with shareholders. That should make short-sellers nervous, and that is a salient point as the company boasts a 15% short interest. Directors have been buyers this year, adding over $140,000 worth of shares.

Follow me on Twitter for more stock ideas, as well as analysis and predictions at http://www.twitter.com/HedgehogTrader

Disclosure: Writer owns Avino Silver. This aricle first appeared on INK Research.

Authentic Sneakers | Vans Shoes That Change Color in the Sun: UV Era Ink Stacked & More – Fitforhealth News