In my latest Talk Digital Network interview with Jim Goddard, I highlight how Canadian insiders have tilted towards old economy stocks. This move is likely in anticipation of better economy growth across the Canadian economy, notably Western Canada. With growth potentially on the upswing, old economy value stocks are likely to be regain favour with investors who will no longer have to pay premium valuations for growth. A shift towards value investing could put the relative performance of previous high flyers such as U.S. FANG (Facebook, Amazon, Netflix and Google) and Canadian marijuana stocks at risk. Indeed, we have already seen some interesting moves this month with auto stocks soaring as some marijuana stocks stumble.

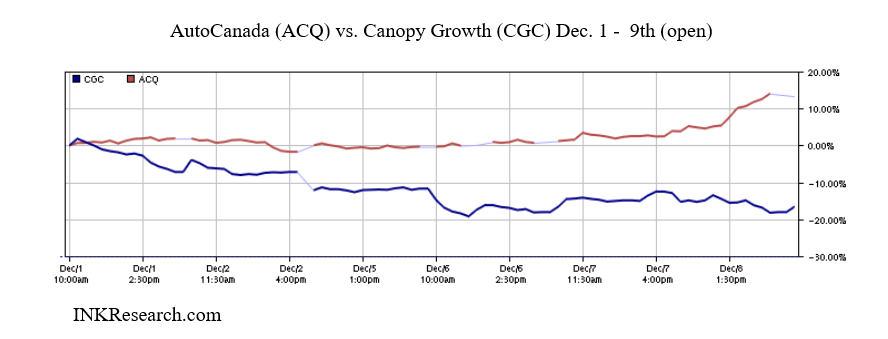

The chart below shows Canopy Growth (CGC) versus AutoCanada (ACQ) so far in December.

Of course, not all growth stocks would be laggards in a value environment. There will be exceptions, likely among market leaders. However, a low rate environment may no longer be there to lift all growth stock boats.

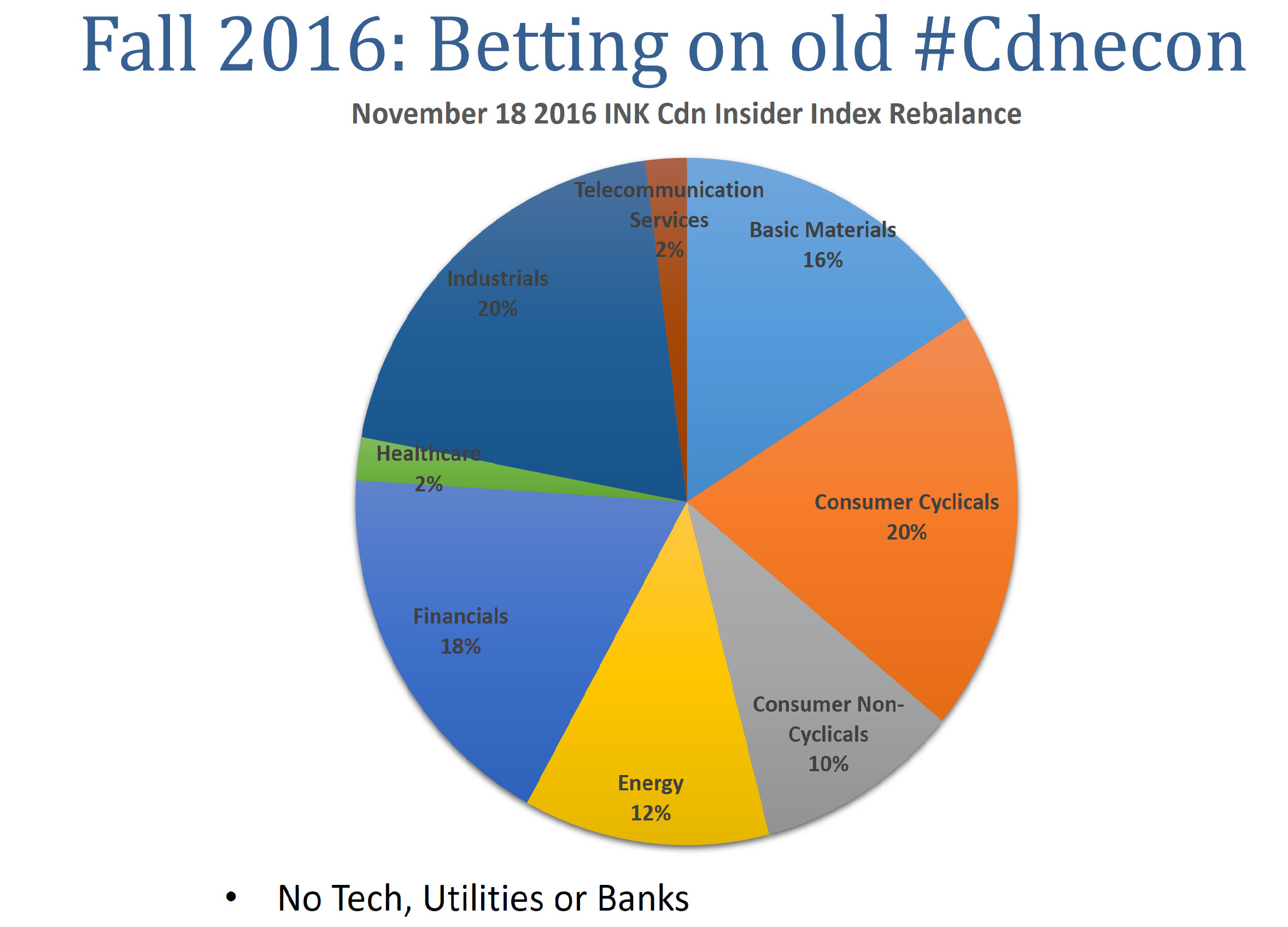

So, what do insiders like? The old stuff: oil patch, farm equipment suppliers (Ag Growth) and pickup truck vendors (Auto Canada). The pie chart below shows the sector allocation of the INK Canadian Insider Index as of the fall rebalance date of November 18th.

The pie chart is part of our Index presentation which can be downloaded in PDF format here.

Listen to or download the interview below or visit Howestreet.com. It is also on YouTube.

No Comments