Technical Overview by Nicholas Winton, Hedgehog Trader and @HedgehogTrader on Twitter

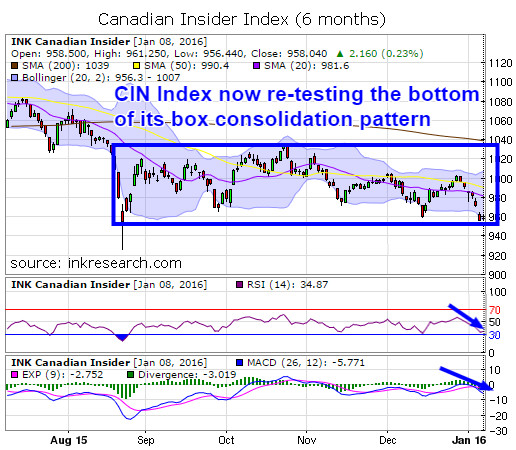

Thank you for joining us for a weekly technical look at the mid-cap oriented INK Canadian Insider (CIN) Index. In our last update, we reiterated how tough a time the INK CIN Index has had breaking up through the 1000 level which it once again found itself pressed up against. With traders back in the saddle last week, volume proved to be no ally, as momentum wilted and we saw another breakout attempt fall short.

Momentum-wise, RSI turned down and now reads just 34.87. MACD turned down strongly as well and remains in negative territory at -5.771. Of course, weakness in the Index was not a major surprise as stock markets worldwide have taken a major beating early on in 2016.

One very positive note is that the INK CIN Index performed very well on Friday, closing in the green 0.23% even as major US indices were in full molten meltdown mode, taking a loss of 1% for the day.

The Index is likely primed for a rebound as it has once again pulled back to its lower Bollinger band and 958-960 major support area which spawned rebounds after the late August and the mid-December corrections. Another positive is that RSI has not broken under 30 since the late August sell-off. Minor resistance is now at 980, its 20-day moving average and major resistance remains at 1000.

Bulls definitely want to see a major turnaround in the next couple of weeks, as the Index has made lower highs and lower lows since its mid-October high. Was Friday's strong performance relative to major markets a positive sign of things to come for the CIN Index? Let's see.

Sports brands | 【国内4月発売予定】プレイステーション5 × ナイキ PG5 PS EP 全2色 - スニーカーウォーズ

Category:

No Comments