Thank you for joining us in a weekly technical look at the mid-cap oriented INK Canadian Insider (CIN) Index. The Index, which started the week by dipping down close to its 20-day moving average before bouncing back, actually slid 2 points to 1188.75.

The Index's short-term momentum indicator (RSI) pulled back 4 points to 61.36, but remains above the robust 60-level. What saw more weakness was the Index's MACD indicator which dropped 2.6 points or 22% to 8.81. We're still seeing strong resistance in the 10-15 area, a nut the Index will likely have to crack to break out significantly.

The weakness was enough to reverse the recently triggered MACD buy signal as the fast blue line crossed back down below the slow red line, giving the Index a MACD sell signal. MACD has enjoyed strong support above the 8 level since early December, so this indicator is worth watching.

The Index's support levels are at 1176 (its 20-day simple moving average) and 1160, while 1190 and 1200 provides overhead resistance.

While we see some headwinds appearing, it's worth noting that over the past year, the Index has returned a substantial return of 31.80% and is in a strong bull trend.

Low-volatility strategies now lagging

Speaking of strong performance, low volatility strategies that seek to deliver growth with lower risk have become all the rage among investors, especially among retirees and institutions. That popularity was kindled as they generally did well during the Obama low-rate, low growth period. However, these ETFs and funds which typically hold large cap dividend paying corporations, have generallly underperformed recently.

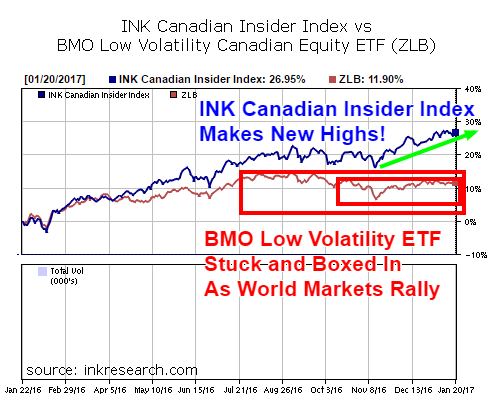

For example, the INK CIN Index performance against some of these popular low-volatility ETFs has been impressive during the past year as the Federal Reserve has signalled it intends to raise rates.

Indeed, The Horizons Cdn Insider ETF (HII) which is based on the mid-cap oriented INK CIN Index has beaten the BMO Low Volatility Equity ETF (ZLB) by about 15% on a price return basis over the past year as of Friday. The ZLB criteria is simply to own the 40 or so lowest beta large cap stocks.

What's more, despite significant gains in the world markets over the past few months, the BMO Low Volatility ETF has not made a new high since September and has been locked in a sideways consolidation since October. Meanwhile, over the past few months the Horizons Cdn Insider ETF (HII) has continued to make new one year and all-time highs, even standing toe to toe with the SPDR S&P 500 ETF (SPY*US).

As we potentially move to a higher rate environment, it appears the low volatility 'hot' investment strategy that offered the prospect of strong returns with low risk is floundering. Perhaps we can mark it down as another hot investment trend gone cold? What seems apparent is that a change in the investment landscape featuring higher growth and commodity prices is rewarding good old fashioned value and growth screening and stock-picking.

INK Research provides indexing services to Horizons ETFs for the Horizons Cdn Insider Index ETF.

No Comments