Technical Overview by Nicholas Winton, Hedgehog Trader and @HedgehogTrader on Twitter

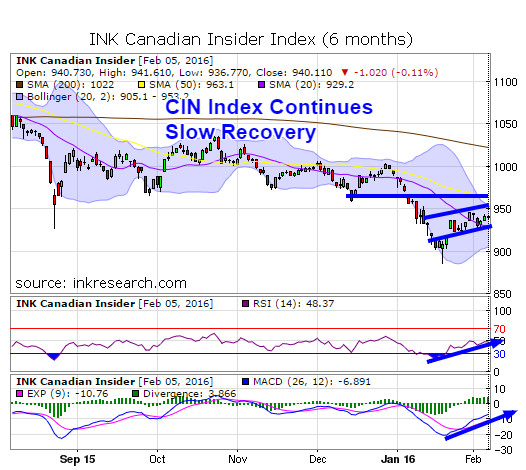

Thank you for joining us in a weekly technical look at the mid-cap oriented INK Canadian Insider (CIN) Index. Last week, the INK CIN Index paused, shedding 5 points or 0.5% after racking up an almost 7% rebound from its lows where it gapped up twice in the span of a week.

RSI slipped back under 50 to 48.37. On the other hand, its MACD momentum indicator managed to make up some ground, rising 5 points to -6.81. For a meaningful advance to occur, bulls would most likely need to see RSI remain above 50 and MACD to move above zero. That scenario is not out of the question, as RSI remains in the '50' ballpark and MACD continues to power its way higher, having recovered 70% from its lows.

As we have noted, a major sell-off and capitulation like the one the Index has just endured tends to generate a powerful reaction in the opposite direction. After August's sell-off, the Index recovered 10% in less than 2 weeks. This time around, the recovery has been more modest over the same period.

Indeed, a furthering of its advance will require a lot of energy, as there is a fair amount of resistance between 950-970. Minor resistance starts at 950 and major resistance can be found at the 50 day moving average at 963. On the positive side, the Index remains above its 20 day moving average of 929.2, its major support. Its minor support sits just below around 925.

Until a major catalyst emerges, the CIN Index appears likely to remain in a trading range within its recent uptrend channel drifting between 929 and 950.

No Comments