With speculation returning to the stock market and spurring on high-flying moves in sectors like gold, silver, lithium, and marijuana-related stocks over the past year, we look for where we might next see some outsized gains from beaten down assets. Lo and behold from the ashes we are starting to see uranium stocks, a painfully bruised and out of favour asset class, looking more and more attractive.

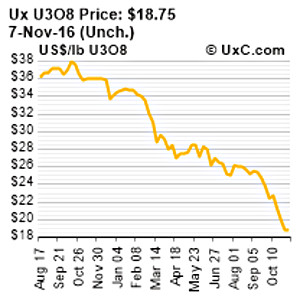

I should start by saying the price of uranium has absolutely plummeted over the past few weeks to US$18.75 a pound, a ridiculous multi-year low. What's positive is that many in the industry would argue that the price appears to be unsustainably low considering it costs many producers $60 per pound to produce. Secondly, seasonally we tend to see uranium stocks bottom around the end of October. Perhaps that's why we are seeing the uranium tracking stock Uranium Participation (U) slowly and deliberately building a base around $3.80 over the past few weeks.

What's interesting against the backdrop of a uranium price smash is that Cameco Corp (CCO), which sets the pace for the entire sector, has been in an uptrend for well over a month after beating earnings estimates and is outperforming the price of uranium and leading the majority of the companies in the sector. Naturally, it's a positive sign when you see a bellwether resource stock outperforming the underlying commodity. It's also often a sign a sector bottom is near.

In another bullish development, President-elect Donald Trump took down the pledge to cancel the Paris Agreement from his website. This gives the beaten-down uranium sector the chance to catch its breath and stage a comeback.

In looking at Cameco, there have been no recent sales by insiders during the uranium price plunge. We like that CEO Tim Gitzel bought 10,000 shares in August in the $12.60 range. Also, two company officers added 5,200 shares total at around $11.42, with the latest buy of 5,000 shares taking place on November 4th. We note that we would like to see Cameco break out above $12 which serves as a strong resistance level.

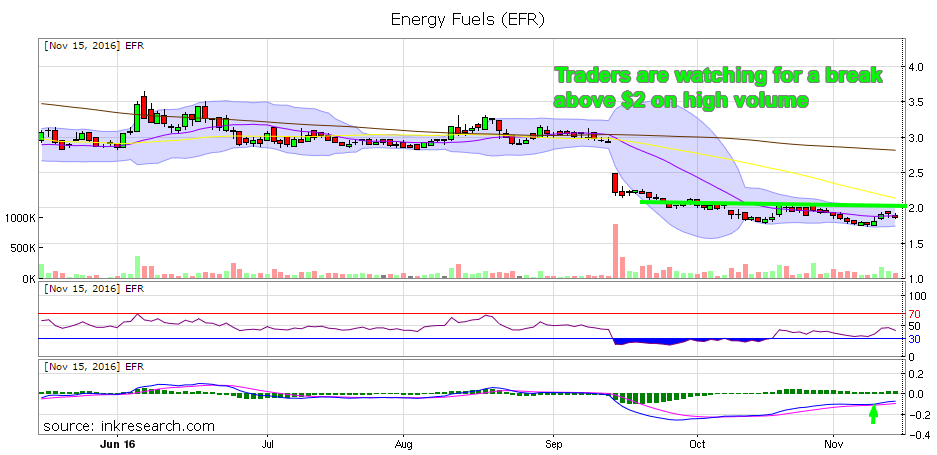

I am watching a couple of uranium stocks that could offer more leverage than Cameco Corp which is, incidentally, the largest uranium producer in the world.

Energy Fuels (EFR) is a uranium producer with a strong production growth profile. In addition, the company had the good fortune to make a high-grade copper discovery at their already very economic uranium project in Arizona that includes an intercept of about 30% copper. And in case you missed the news, copper is up over 20% in the past 10 days alone. The upshot is that this copper discovery is likely to make Energy Fuels' Arizona play an even more profitable enterprise. The company is cashed up and is looking to capitalize on an upswing in the out of favour uranium sector.

Skyharbour Resources (SYH) has a number of very prospective properties and a pair of executives who each built a company and sold them for a major profit: Trelawney Resources (gold) and JNR Resources (uranium). Skyharbour owns 100% of Falcon Point (which, so far, has 7M lbs of uranium and 5M lbs of Thorium) in the east (north of this at Hook Lake is some very high grade uranium property). They have 50% ownership of a large property called Preston Lake in the Patterson Lake region of northwestern Saskatchewan, bordering two major discoveries. And they have an option to acquire 100% of Moore Lake which has known high grade uranium and great infrastructure.

In looking at insider activity, the signs are very bullish. Denison Mines (DML) now owns 5 million shares, about 12%, of Skyharbour. Skyharbour CEO Jordan Trimble has been scooping up shares since August, adding 260,000. This summer director David Cates, who is also President and CEO of Denison Mines and Uranium Participation added 140,000 shares. Officer Rick Kusmirski bought 250,000 shares and Gabriel McDonald added 35,000 shares. KCR LLC bought 270,000 shares. There haven't been any sales in recent memory. Skyharbour has a very bullish looking chart and my Hedgehog Trader Newsletter subscribers have been long since April when we noticed signs of accumulation.

Stay tuned to my Twitter stream @HedgehogTrader for more updates, commentary and predictions on uranium and other stocks we cover.

This article was originally published for INKResearch.com subscribers on November 16, 2016.

jordan Sneakers | New Balance 530 Til Kvinder, hvid - MR530SG

No Comments