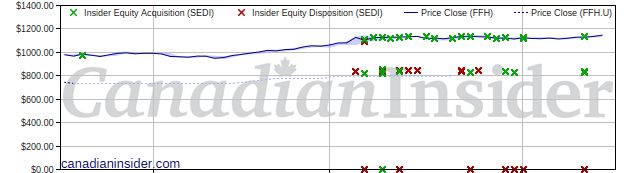

Fairfax Financial Holding (FFH) has notable insider buying

Fairfax Financial Holding (T:FFH)

Christine N. McLean, a Director, acquired 6 Subordinate Voting Shares on a direct ownership basis at a price of $1131.980 through the public market on September 13th, 2023. This represents a $6,792 investment into the company's shares and an account share holdings change of 0.6%.

Benjamin P. Watsa, a Director, acquired 3 Subordinate Voting Shares on a direct ownership basis at a price of $1131.980 through the public market on September 13th, 2023. This represents a $3,396 investment into the company's shares and an account share holdings change of 0.6%.

William Conrad Weldon, a Director, acquired 16 Subordinate Voting Shares on a direct ownership basis at a price of $836.100USD through the public market on September 13th, 2023. This represents a $18,128 investment into the company's shares and an account share holdings change of 2.0%.

Fairfax Financial Holdings Limited is a Canada-based holding company. The Company, through its subsidiaries, is engaged in property and casualty insurance and reinsurance and the associated investment management. The Company's segments include Property and Casualty Insurance and Reinsurance, Life insurance and Run-off and Non-insurance companies. The Property and Casualty Insurance and Reinsurance segment includes North American Insurers, Global Insurers and Reinsurers and International Insurers and Reinsurers. The Life Insurance and Run-off segment include Eurolife and Run-off. The Non-insurance companies segment includes restaurants and retail, Fairfax India, Thomas Cook India and others. Eurolife underwrites traditional life insurance policies (endowments, deferred annuities, whole life and term life), group benefits, including retirement benefits, and accident and health insurance policies. The North American Insurers include Northbridge, Crum & Forster and Zenith National.

Headlines: Sep 18, 2023

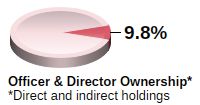

FFH Insider Holdings Chart