CEO selling at Partners Value Investment (PVF)

CEO selling at Partners Value Investment (V:PVF)

Updated Monday Aug 08, 2022 03:07 AM EDT

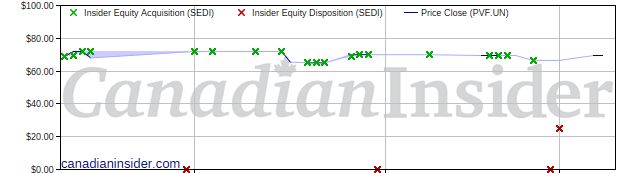

Brian Lawson, CEO and Director, disposed of 200,000 Limited Partnership Units Class A Preferred, Series 1 on an indirect ownership basis for registered holder Wylbrook Investments at a price of $25.000USD through a private transaction on August 2nd, 2022. This represents a $6,428,000 divestment of the company's shares and an account share holdings change of -35.6%.Partners Value Investment is in the Investment Management & Fund Operators Sub Industry Group under the Financials Sector.

Partners Value Investments L.P. is a Canada-based investment partnership. The Company's principal investment is an ownership interest in approximately 130 million Class A Limited Voting Shares (Brookfield shares) of Brookfield Asset Management Inc. (Brookfield). Its objective is to provide the Equity Limited Partners with capital appreciation and Preferred Limited Partners with income returns. Investment income includes dividends from its investment in Brookfield shares and other securities. The Company's investment in Brookfield is owned through its subsidiaries Partners Value Investments Inc. (PVII) and Partners Value Split Corp. (Partners Value Split). It also holds a portfolio of other securities, including investments in limited partnership units of Brookfield Property Partners (BPY), Brookfield Business Partners (BBU) and a diversified portfolio of other securities. The Company is managed by its general partner, PVI Management Trust (the General Part).