Off-market insider buying at Tembo Gold (TEM)

Off-market insider buying at Tembo Gold (:TEM)

Updated Friday Jul 30, 2021 02:20 AM EDT

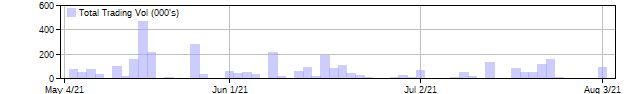

Walter David Scott, CEO and Director, acquired 666,666 Common Shares on a direct ownership basis at a price of $0.150 through a prospectus or prospectus exempt offering on July 28th, 2021. This represents a $100,000 investment into the company's shares and an account share holdings change of 16.3%. Marc Cernovitch, a Director, acquired 403,333 Common Shares on a direct ownership basis at a price of $0.150 through a prospectus or prospectus exempt offering on July 28th, 2021. This represents a $60,500 investment into the company's shares and an account share holdings change of 98.8%.

Simon Charles Benstead, CFO, Director and 10% Holder, acquired 399,983 Common Shares on a direct ownership basis at a price of $0.150 through a prospectus or prospectus exempt offering on July 28th, 2021. This represents a $59,997 investment into the company's shares and an account share holdings change of 3.1%.

Tembo Gold is in the Gold Sub Industry Group under the Basic Materials Sector.

Tembo Gold Corp. is an exploration-stage company. The Company is engaged in the acquisition, exploration and development of mineral properties in Tanzania, East Africa. The Company is engaged in the exploration and development of unproven exploration and evaluation assets. Its exploration and evaluation assets are located in Tanzania, and its corporate assets are located in Canada. Its main asset is the Tembo gold property (the Tembo Project) located in northwest Tanzania. The project is located directly northwest of and adjacent to the Bulyanhulu mine and comprises approximately 40 contiguous prospecting licenses and license applications covering a total area of approximately 110 square kilometers. Geologically, the Tembo Project is situated in the Lake Victoria goldfield in the Sukumaland greenstone belt, an Archean age succession of volcanic and sedimentary rocks. The Company has no revenues. Tembo Gold Corp. (TEM) has a high amount of executive buying compared to its micro-cap peers in the market over the past three months. According to regulatory filings yesterday, three insiders have invested a total amount of $220,497.