Multiple buying at ESSA Pharma (EPI)

Multiple buying at ESSA Pharma (V:EPI)

Updated Wednesday Aug 05, 2020 03:02 AM EDT

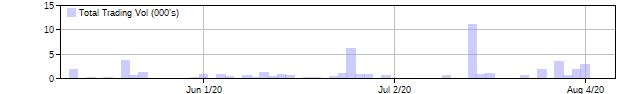

Clarus Lifesciences III, a 10% Holder, acquired 200,000 Common Shares on a direct ownership basis at a price of US$6.000USD through a prospectus or prospectus exempt offering on July 31st, 2020. This represents a $1,608,480 investment into the company's shares and an account share holdings change of 5.9%. In addition, Franklin Milan Berger, a Director, acquired 100,000 Common Shares on a direct ownership basis. This represents a $804,240 investment into the company's shares and an account share holdings change of 17.9%. Scott Requadt, a Director, acquired 25,000 Common Shares on a direct ownership basis. This represents a $201,060 investment into the company's shares and an account share holdings change of greater than 100%.

Two other insiders also participated in smaller amounts.

ESSA Pharma is in the Biotechnology & Medical Research Sub Industry Group under the Healthcare Sector.

ESSA Pharma, Inc. is a Canada-based pharmaceutical company. The Company is focused on developing therapies for the treatment of castration-resistant prostate cancer (CRPC). It is developing EPI-7386 for the treatment of metastatic CRPC (mCRPC). It is also developing EPI-7386 combination therapy for mCRPC. In addition to this, the Company's pipeline also includes antien for triple negative androgen receptor (AR+) breast cancer. Its aniten compounds bind to the N-terminal domain of the androgen receptor (AR), inhibiting AR driven transcription and the AR signaling pathway in a manner which bypasses the drug resistance mechanisms associated with current anti-androgens. ESSA Pharma Inc. (EPI) has a high amount of executive buying compared to its small-cap peers in the market over the past three months. According to regulatory filings yesterday, five insiders have invested a total amount of $2,747,815.