Off-market insider buying at CMC Metals (CMB)

Off-market insider buying at CMC Metals (V:CMB)

Updated Tuesday Jul 28, 2020 04:19 AM EDT

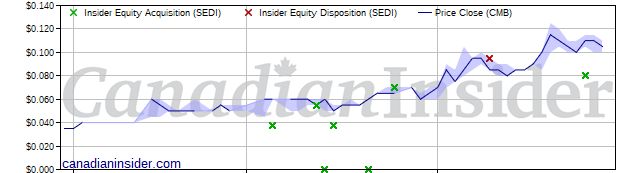

Michael Curt Scholz, CFO and 10% Holder, acquired 1,875,000 Common Shares on a direct ownership basis at a price of $0.080 through a prospectus or prospectus exempt offering on July 27th, 2020. The insider also acquired 1,875,000 Warrants on a direct ownership basis at an exercise price of $0.100 for one year. This represents a $150,000 investment into the company's shares and an account share holdings change of 16.6%.CMC Metals is in the Precious Metals & Minerals Sub Industry Group under the Basic Materials Sector.

CMC Metals Ltd. is engaged in the acquisition and exploration of mineral properties in Canada and the United States. The Company is reviewing various properties of merit and capital asset acquisitions that will support its focus of developing properties. Its properties include Logjam Property, Radcliff Mine, Black Horse Mine/Chesco Claims and Silver Hart Property. The Logjam Property is located in the Watson Lake Mining District, Yukon Territories. The Radcliff gold property is located in the west-central portion of the Panamint Range, Inyo County, southeastern California. The Radcliff gold property encompasses approximately 1,650 acres and consists of approximately 10 patented mining claims, a patented mill site claim, over 80 unpatented mining claims and approximately five unpatented mill sites. The Silver Hart Property is located in the Watson Lake Mining District, Yukon Territories. It has not generated any revenues. Its subsidiaries include 0877887 B.C Ltd. and CMC Metals Corp. CMC Metals Ltd. (CMB) has a high amount of executive buying compared to its micro-cap peers in the market over the past three months. According to regulatory filings yesterday, one insider has invested a total amount of $150,000.