EdgePoint Investment Group buying at AutoCanada (ACQ)

EdgePoint Investment Group buying at AutoCanada (T:ACQ)

Updated Tuesday Apr 23, 2024 02:07 AM EDT

EdgePoint Investment Group Inc., a 10% Holder, acquired 12,200 Common Shares on a control or direction basis for registered holder EdgePoint Equity Fund at prices ranging from $23.830 to $23.908 between April 15th, 2024 and April 16th, 2024. This represents a $291,571 investment into the company's shares and an account share holdings change of 0.2%.AutoCanada is in the Auto Vehicles, Parts & Service Retailers Sub Industry Group under the Consumer Cyclicals Sector.

AutoCanada Inc. is a Canada-based multi-location franchised automobile dealership company. The Company offers a diversified range of automotive products and services, including new vehicles, used vehicles, vehicle leasing, vehicle parts, vehicle maintenance and collision repair services, extended service contracts, vehicle protection products, after-market products and auction services. The Company also arranges financing and insurance for vehicles purchased by its customers through third-party finance and insurance sources. Its segments include Canadian Operations and U.S. Operations. It operates 83 franchised dealerships, comprising of 28 brands, in eight provinces in Canada as well as a group in Illinois, United States of America. It sells Chrysler, Dodge, Jeep, Ram, FIAT, Alfa Romeo, Chevrolet, GMC, Buick, Cadillac, Ford, Infiniti, Nissan, Hyundai, Subaru, Audi, Volkswagen, Kia, Mazda, Mercedes-Benz, BMW, MINI, Volvo, Toyota, Lincoln, Acura, and Honda brands. AutoCanada Inc. (ACQ) has a high amount of executive buying compared to its mid-cap peers in the market over the past three months. According to regulatory filings yesterday, one insider has invested a total amount of $291,571.

Headlines: Apr 23, 2024

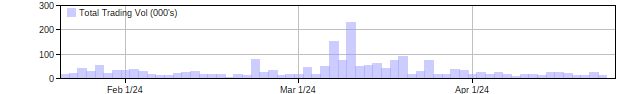

ACQ Insider Holdings Chart

Issuer details as of Apr 23, 2024 2:07 ET

Latest Price

24.45

1 Day Change

1.24%

52 Week High

27.54

52 Week Low

15.14

QMV ($Mils)

575,369,307

Issuer website: https://investors.autocan.ca/