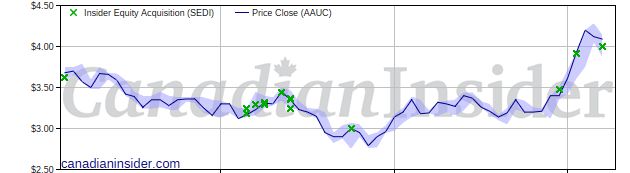

Public market insider buying at Allied Gold (AAUC)

Public market insider buying at Allied Gold (T:AAUC)

Updated Monday Apr 08, 2024 03:43 AM EDT

Fernandez-Tobar Gerardo, a Senior Officer, acquired 32,600 Common Shares on a direct ownership basis at prices ranging from $3.920 to $4.000 between April 2nd, 2024 and April 5th, 2024. This represents a $128,752 investment into the company's shares and an account share holdings change of 1.7%.Allied Gold is in the Gold Sub Industry Group under the Basic Materials Sector.

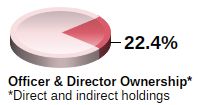

Allied Gold Corporation is a Canadian gold producer. The Company operates a portfolio of three producing assets and development projects located in Cote d'Ivoire, Mali, Ethiopia and Egypt. Its properties include Sadiola gold mine, Kurmuk Project, Bonikro Mine, Agbaou Mine, El Fawakheir Property, and Diba Project. The Sadiola Mine is an operating open pit gold mine located 77 km south of the regional city of Kayes. The Kurmuk Project is located in western Ethiopia, approximately 750 km west-northwest of the capital city of Addis Ababa. The Bonikro Mine is an operating gold mine located 100 km by road south of the capital city of Cote d'Ivoire, Yamoussoukro. Agbaou Mine is located 100 km by road south of the capital Yamoussoukro, in the Goh-Djiboua District of Cote d'Ivoire in West Africa. El Fawakheir Property is located in the Central Eastern Desert of Egypt. The Diba Project is located in western Mali, combining Korali-Sud Small Scale Mining License and Lakanfla Exploration License. Allied Gold Corporation (AAUC) has a high amount of executive buying compared to its mid-cap peers in the market over the past three months. According to recent regulatory filings, one insider has invested a total amount of $128,752.

Headlines: Apr 08, 2024

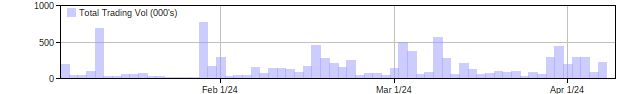

AAUC Insider Holdings Chart

Issuer details as of Apr 08, 2024 3:43 ET

Latest Price

4.09

1 Day Change

-0.73%

52 Week High

5.9

52 Week Low

2.75

QMV ($Mils)

1,025,462,195

Issuer website: https://alliedgold.com/