Public market insider buying at ECN Capital (ECN)

Public market insider buying at ECN Capital (T:ECN)

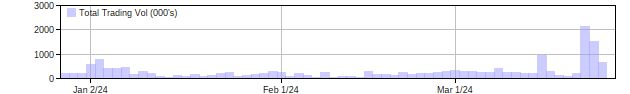

Updated Tuesday Mar 26, 2024 07:02 AM EDT

Steven Kenneth Hudson, CEO and Director, acquired 300,000 Common Shares on a direct ownership basis at a price of $1.790 on March 25th, 2024. This represents a $537,000 investment into the company's shares and an account share holdings change of 2.3%. William Wayne Lovatt, a Director, acquired 200,000 Common Shares on a direct ownership basis at a price of $1.710 on March 25th, 2024. This represents a $342,000 investment into the company's shares and an account share holdings change of 25.0%.

ECN Capital is in the Corporate Financial Services Sub Industry Group under the Financials Sector.

ECN Capital Corp. is a Canada-based provider of business services to North American banks, credit unions, life insurance companies, pension funds and institutional investors (collectively, its Partners). The Company originates, manages and advises on credit assets on behalf of its Partners, specifically consumer (manufactured housing and recreational vehicle and marine) loans and commercial (inventory finance or floorplan) loans. The Company operates through two segments: Manufactured Housing Finance, and Recreational Vehicles and Marine Finance. It operates through three businesses: Triad Financial Services, which manufactures home loans; Source One Financial, which is engaged in nationwide marine and RV lending; and Intercoastal Finance Group, which is engaged in national marine and RV lending. It provides prime credit portfolio solutions: Secured consumer loan portfolios, which manufactures home loans, and Secured consumer loan portfolios, which provides marine and RV loans.

Headlines: Mar 26, 2024

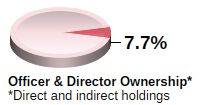

ECN Insider Holdings Chart

Issuer details as of Mar 27, 2024 2:15 ET

Latest Price

1.83

1 Day Change

1.67%

52 Week High

3.38

52 Week Low

1.6

QMV ($Mils)

512,302,538

Issuer website: https://www.ecncapitalcorp.com/