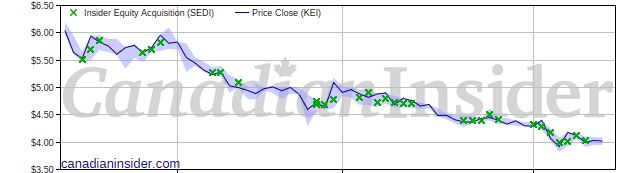

Public market insider buying at Kolibri Global Energy (KEI)

Public market insider buying at Kolibri Global Energy (T:KEI)

Updated Wednesday Feb 14, 2024 02:43 AM EDT

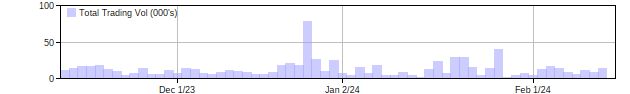

David Loren Neuhauser, a Director, acquired 29,300 Common Shares on a control or direction basis for registered holder Livermore Partners at prices ranging from $3.990 to $4.330 between February 1st, 2024 and February 9th, 2024. This represents a $121,092 investment into the company's shares and an account share holdings change of 0.5%.Kolibri Global Energy is in the Oil & Gas Exploration and Production Sub Industry Group under the Energy Sector.

Kolibri Global Energy Inc. is an international energy company. The Company is focused on finding and exploiting energy projects in oil, gas, and clean and sustainable energy. Through various subsidiaries, the Company owns and operates energy properties in the United States. It is also focused on identifying and acquiring additional projects. The Company has operations in the Ardmore Basin, Oklahoma. It holds approximately 17,200 net contiguous acres and its reserves are from the Caney Formation. The Company is also focused on the continued development and exploitation of its Tishomingo field in Oklahoma. Its subsidiaries include BNK Petroleum Holding Inc., BNK Petroleum (US) Inc., BNK Sedano Hidrocarburos, S.L., BNK Canada Holdings, Inc., and BNK Sedano Holdings B.V. Kolibri Global Energy Inc. (KEI) has below median officer and director direct ownership compared to its small-cap peers in the market, based on our estimate using SEDI data. According to regulatory filings yesterday, one insider has invested a total amount of $121,092.

Headlines: Feb 14, 2024

KEI Insider Holdings Chart

Issuer details as of Feb 14, 2024 2:43 ET

Latest Price

4.02

1 Day Change

-0.25%

52 Week High

6.92

52 Week Low

3.82

QMV ($Mils)

143,214,860

Issuer website: https://www.kolibrienergy.com/