Public market insider buying at Fortuna Silver Mines (FVI)

Public market insider buying at Fortuna Silver Mines (T:FVI)

Updated Friday Apr 30, 2021 04:00 AM EDT

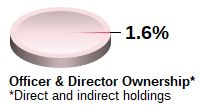

Jorge A. Ganoza Durant, CEO and Director, acquired 33,000 Common Shares on a direct ownership basis at a price of US$6.060 on April 28th, 2021. This represents a $247,103 investment into the company's shares and an account share holdings change of 2.2%. In addition, Luis Dario Ganoza Durant, CFO, acquired 33,000 Common Shares on a direct ownership basis at prices ranging from $7.430 to $7.440 on April 28th, 2021. This represents a $245,320 investment into the company's shares and an account share holdings change of 6.1%. David Charles Laing, a Director, acquired 10,000 Common Shares on a direct ownership basis at a price of $7.630 on April 28th, 2021. This represents a $76,299 investment into the company's shares and an account share holdings change of greater than 100%.

Fortuna Silver Mines is in the Integrated Mining Sub Industry Group under the Basic Materials Sector.

Fortuna Silver Mines Inc. is a Canada-based precious metals mining company with operations in Peru, Mexico and Argentina. The Company is primarily engaged in producing silver and gold minerals. The Company's operated mines and projects include San Jose Mine, Caylloma Mine and Lindero Mine. The San Jose Mine is an underground silver-gold mine located in the state of Oaxaca in southern Mexico. The Caylloma property is an underground silver, lead and zinc mine located approximately 220 kilometers northwest of the Arequipa Department in southern Peru. Its commercial products are silver-lead and zinc concentrates. The Lindero Mine is a gold and copper mine, which is located in the Argentinian puna.

Headlines: Apr 30, 2021

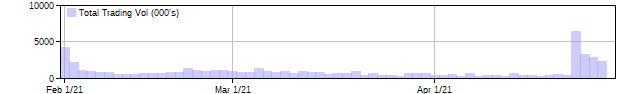

FVI Insider Holdings Chart

Issuer details as of Apr 30, 2021 4:00 ET

Latest Price

7.42

1 Day Change

-1.85%

52 Week High

12.61

52 Week Low

4

QMV ($Mils)

1,366,732,294

Issuer website: https://www.fortunamining.com/