Public market insider selling at Braille Energy Systems (BES)

Public market insider selling at Braille Energy Systems (V:BES)

Updated Wednesday Feb 17, 2021 05:22 AM EDT

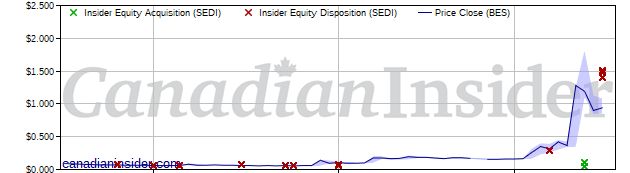

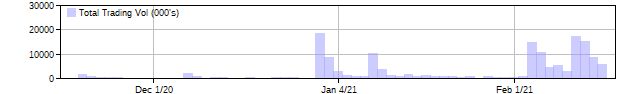

Lindsay Thomas Weatherdon, CEO and Director, disposed of 829,849 Common Shares on a direct ownership basis at a price of $1.480 on February 16th, 2021. This represents a $1,228,177 divestment of the company's shares and an account share holdings change of -76.8%. Jeffrey York, a Director and 10% Holder, disposed of 617,424 Common Shares on a direct ownership basis at a price of $1.510 on February 16th, 2021. This represents a $932,310 divestment of the company's shares and an account share holdings change of -22.7%.

Judith Tendai Mazvihwa, CFO, disposed of 189,056 Common Shares on a direct ownership basis at a price of $1.400 on February 16th, 2021. This represents a $264,678 divestment of the company's shares and an account share holdings change of -48.6%.

Braille Energy Systems is in the Auto, Truck & Motorcycle Parts Sub Industry Group under the Consumer Cyclicals Sector.

Braille Energy Systems Inc, formerly Mincom Capital Inc, is a Canada-based battery-manufacturing and energy storage company. It supplies batteries to the motor sports industry and battery systems for the transportation market. The Company has manufacturing facilities in North America.

Headlines: Feb 17, 2021

BES Insider Holdings Chart

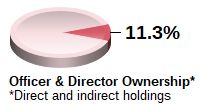

Issuer details as of Feb 17, 2021 5:22 ET

Latest Price

0.94

1 Day Change

4.44%

52 Week High

1.82

52 Week Low

0.005

QMV ($Mils)

44,896,522

Issuer website: https://brailleenergy.com/