Public market insider buying at Wilmington Capital (WCM)

Public market insider buying at Wilmington Capital (T:WCM)

Updated Wednesday Sep 23, 2020 04:16 AM EDT

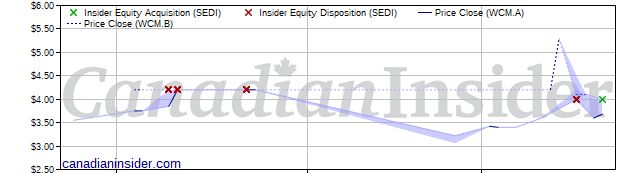

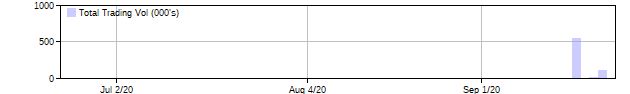

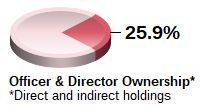

Christopher Killi, CFO and Director, acquired 100,700 Common Shares Class A on a direct ownership basis at a price of $4.000 on September 22nd, 2020. This represents a $402,800 investment into the company's shares and an account share holdings change of greater than 100%. In addition, Joseph F. Killi, CEO, Director and 10% Holder, acquired 2,700 Common Shares Class B on an indirect ownership basis for registered holder Rosebridge Capital Corp. Inc. at a price of $4.000 on the same day. This represents a $10,800 investment into the company's shares and an account share holdings change of 0.6%.

Wilmington Capital is in the Investment Management & Fund Operators Sub Industry Group under the Financials Sector.

Wilmington Capital Management Inc. is an investment and asset management company focused on investments in the real estate and energy sectors. The Company invests its own capital alongside partners and co-investors, in hard assets and private equity funds, and manages these assets through operating platforms. The Company, through Northbridge Capital Partners Ltd., focuses on investing private equity in companies operating in the energy and real estate sector. The Company holds Maple Leaf Marinas Holdings Limited Partnership and the Bay Moorings Marina Holdings Limited Partnership, which owns and operates four marinas in Ontario having approximately 1,700 boat slips and 100 acres of waterfront land, including development land. Wilmington Capital Management Inc. (WCM) has a high amount of executive buying compared to its micro-cap peers in the market over the past three months. According to regulatory filings yesterday, two insiders have invested a total amount of $413,600.

Headlines: Sep 23, 2020

WCM Insider Holdings Chart

Issuer details as of Sep 23, 2020 4:16 ET

Latest Price

3.68

1 Day Change

2.22%

52 Week High

7.26

52 Week Low

3.06

QMV ($Mils)

45,359,069

Issuer website: https://www.wilmingtoncapital.com/