Public market insider buying at Tricon Capital Group (TCN)

Public market insider buying at Tricon Capital Group (T:TCN)

Updated Tuesday Apr 07, 2020 03:47 AM EDT

Gary Berman, CEO and Director, acquired 65,000 Common Shares on a direct ownership basis at prices ranging from $6.676 to $6.956 between April 1st, 2020 and April 3rd, 2020. This represents a $445,920 investment into the company's shares and an account share holdings change of 8.5%.Tricon Capital Group is in the Real Estate Services Sub Industry Group under the Financials Sector.

Tricon Capital Group Inc. is a Canada-based company, which is a principal investor and asset manager focused on the residential real estate industry in North America. The Company operates through five segments: Private Funds and Advisory (PF&A), Principal Investing in Tricon Housing Partners (THP), Tricon American Homes (TAH), Tricon Lifestyle Communities (TLC) and Tricon Lifestyle Rentals (TLR). In Private Funds and Advisory, the Company manages, on behalf of private investors, commingled funds, sidecars and separate investment accounts that invest in the development of real estate in North America. Tricon's investment activities are carried on through Tricon Housing Partners (land and homebuilding), Tricon American Homes (single-family rental), Tricon Lifestyle Communities (manufactured housing communities) and Tricon Lifestyle Rentals (purpose-built multi-family apartments). It manages capital on behalf of third-party institutional and high net-worth accredited investors. Tricon Capital Group Inc. (TCN) has a high amount of executive buying compared to its mid-cap peers in the market over the past three months. According to regulatory filings yesterday, one insider has invested a total amount of $445,920.

Headlines: Apr 07, 2020

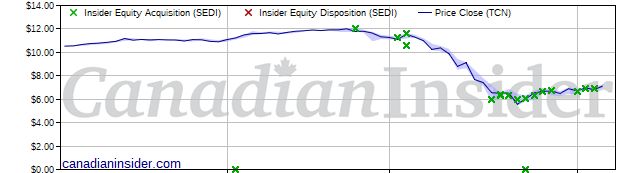

TCN Insider Holdings Chart

Issuer details as of Apr 07, 2020 3:47 ET

Latest Price

7.12

1 Day Change

4.40%

52 Week High

12.11

52 Week Low

5.45

QMV ($Mils)

1,383,620,657