Public market insider buying at TransAlta (TA)

Public market insider buying at TransAlta (T:TA)

Updated Tuesday Apr 07, 2020 03:48 AM EDT

Brookfield Asset Management Inc. (BAM), a 10% Holder, acquired 173,179 Common Shares on an indirect ownership basis for registered holder BIF IV EAGLE NR CARRY LP and 108,059 Common Shares on an indirect ownership basis for registered holder EAGLE CANADA COMMON HOLDINGS LP at prices ranging from $6.960 to $7.000 between April 1st and 3rd, 2020. This represents a $1,962,034 investment into the company's shares and an account share holdings change of 0.9%.TransAlta is in the Independent Power Producers Sub Industry Group under the Utilities Sector.

TransAlta Corp is a power generating company. The Company owns, operates and manages a portfolio of assets representing approximately 8,273 megawatts (MW) of capacity and uses a range of generation fuels comprised of coal, natural gas, water, solar and wind. Its segments include Generation Segments and Energy Marketing Segment. Generation Segments include six segments: Canadian Coal, United States (US) Coal, Canadian Gas, Australian Gas, Wind and Solar and Hydro. Its Energy Marketing segment is engaged in the wholesale trading of electricity and other energy-related commodities and derivatives. Energy Marketing manages available generating capacity as well as the fuel and transmission needs of the generation segments by utilizing contracts of various durations for the forward sales of electricity and for the purchase of natural gas and transmission capacity. TransAlta Corporation (TA) has a high amount of executive buying compared to its mid-cap peers in the market over the past three months. According to regulatory filings yesterday, one insider has invested a total amount of $1,962,034.

Headlines: Apr 07, 2020

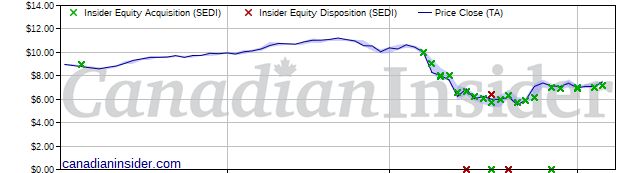

TA Insider Holdings Chart

Issuer details as of Apr 07, 2020 3:48 ET

Latest Price

7.48

1 Day Change

5.65%

52 Week High

11.23

52 Week Low

5.32

QMV ($Mils)

2,094,039,023

Issuer website: https://transalta.com