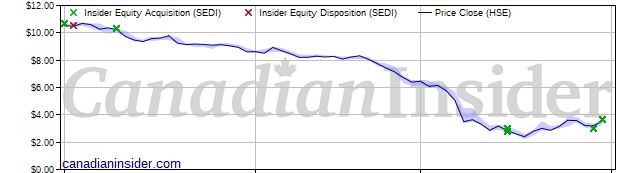

Public market insider buying at Husky Energy (HSE)

Public market insider buying at Husky Energy (T:HSE)

Updated Wednesday Apr 01, 2020 03:38 AM EDT

Robert John Peabody, CEO and Director, acquired 100,000 Common Shares on a direct ownership basis at prices ranging from $3.622 to $3.654 on March 31st, 2020. This represents a $363,800 investment into the company's shares and an account share holdings change of 51.2%. Stephen Edward Bradley, a Director, acquired 17,000 Common Shares on a direct ownership basis at prices ranging from $2.800 to $3.000 between March 16th and 30th, 2020. This represents a $49,000 investment into the company's shares and an account share holdings change of greater than 100%.

Husky Energy is in the Oil & Gas Refining and Marketing Sub Industry Group under the Energy Sector.

Husky Energy Inc is a Canada-based company engaged in oil and gas refining and marketing sector. The Company has two core businesses, Integrated Corridor and Offshore. Integrated Corridor operates in Western Canada and the United States, where thermal production is integrated with the Downstream business and supported by Western Canada operations. Offshore the Company is focused in the Asia Pacific and Atlantic regions. The Company is focused on returns from investment in a portfolio of opportunities that can generate increased funds from operations and free cash flow. Husky Energy Inc. (HSE) has below median officer and director direct ownership compared to its mid-cap peers in the market, based on our estimate using SEDI data. According to regulatory filings yesterday, two insiders have invested a total amount of $412,800.

Headlines: Apr 01, 2020

Insider Holdings Chart

Issuer details as of Apr 01, 2020 3:38 ET

Latest Price

3.54

1 Day Change

10.28%

52 Week High

14.9

52 Week Low

2.21

QMV ($Mils)

3,558,130,953