Public market insider buying at Ivanhoe Mines (IVN)

Public market insider buying at Ivanhoe Mines (T:IVN)

Updated Monday Mar 23, 2020 03:50 AM EDT

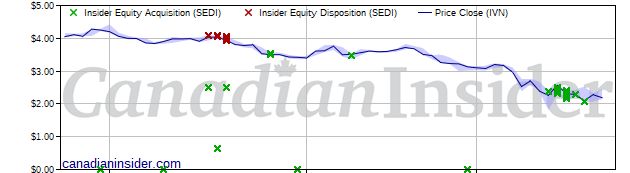

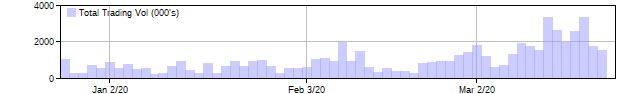

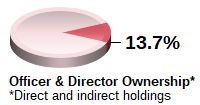

Robert Martin Friedland, a Senior Officer, Director and 10% Holder, acquired 500,000 Common Shares Class A on a direct ownership basis at prices ranging from $2.200 to $2.380 between March 16th, 2020 and March 17th, 2020. This represents a $1,147,327 investment into the company's shares and an account share holdings change of 2.1%.Ivanhoe Mines is in the Integrated Mining Sub Industry Group under the Basic Materials Sector.

Ivanhoe Mines Ltd is a Canada-based mining company. The Company's segments include the Platreef property, Kamoa Holding joint venture and Kipushi properties. The reportable segments are engaged in the development of mineral properties in South Africa; exploration and development of mineral properties through a joint venture in the Democratic Republic of Congo (DRC); and the upgrading of mining infrastructure and refurbishment of a mine in the DRC respectively. It is focused on three projects in Southern Africa: the development of new mines at the Kamoa-Kakula copper discovery in the Democratic Republic of Congo (DRC) and the Platreef platinum-palladium-nickel-copper-gold discovery in South Africa; and the redevelopment and upgrading of the Kipushi zinc-copper-germanium-silver mine, also in the DRC.

Headlines: Mar 23, 2020

IVN Insider Holdings Chart

Issuer details as of Mar 23, 2020 3:50 ET

Latest Price

2.19

1 Day Change

-3.95%

52 Week High

4.54

52 Week Low

1.8

QMV ($Mils)

2,620,967,106

Issuer website: https://www.ivanhoemines.com/