Public market insider buying at First Capital REIT (FCR)

Public market insider buying at First Capital REIT (T:FCR)

Updated Wednesday Mar 18, 2020 03:28 AM EDT

Dori Segal, a Director, acquired 13,000 Trust Units on a direct ownership basis at a price of $15.210 on March 17th, 2020. This represents a $197,730 investment into the company's shares and an account share holdings change of 1.2%. Adam Elliot Paul, CEO, Director and Subsidiary Executive, acquired 7,000 Trust Units on a direct ownership basis at a price of $15.500 on March 17th, 2020. This represents a $108,500 investment into the company's shares and an account share holdings change of 11.8%.

Alison Gail Harnick, a Senior Officer, acquired 320 Trust Units on a direct ownership basis at a price of $15.470 on March 17th, 2020. This represents a $4,950 investment into the company's shares and an account share holdings change of greater than 100%.

First Capital REIT is in the Real Estate Development & Operations Sub Industry Group under the Financials Sector.

First Capital Realty Inc. (FCR) is engaged in the business of acquiring, developing, redeveloping, owning and managing mixed-use urban real estate. FCR operates through three segments: Eastern, which includes operations primarily in Quebec and Ottawa; Central, which includes the FCR's Ontario operations excluding Ottawa; and Western, which includes operations in Alberta and British Columbia. FCR's portfolio includes approximately 158 Canadian properties, totaling approximately 23.5 million square feet of gross leasable area. FCR's properties include Shops at King Liberty, 3080 Yonge Street, 2150 Lake Shore Boulevard West, Avenue and Lawrence Assets, Bayside Village, Leaside Village, Olde Oakville Market Place, Rutherford Marketplace and Edmonton Brewery District.

Headlines: Mar 18, 2020

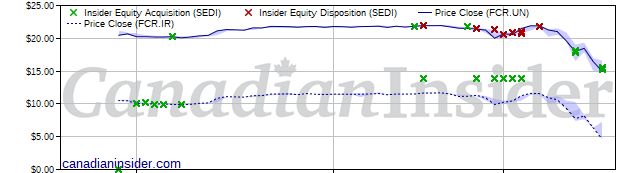

FCR Insider Holdings Chart

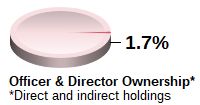

Issuer details as of Mar 18, 2020 3:28 ET

Latest Price

14.98

1 Day Change

-9.05%

52 Week High

22.09

52 Week Low

14.94

QMV ($Mils)

3,265,712,743

Issuer website: https://fcr.ca/