Public market insider buying at Dominion Lending Centres (DLCG)

Public market insider buying at Dominion Lending Centres (T:DLCG)

Updated Thursday Jun 23, 2022 02:04 AM EDT

Belkorp Industries Inc., a 10% Holder, acquired 105,000 Common Shares Class A on a direct ownership basis at a price of $3.390 on June 22nd, 2022. This represents a $355,950 investment into the company's shares and an account share holdings change of 0.7%.Dominion Lending Centres is in the Investment Management & Fund Operators Sub Industry Group under the Financials Sector.

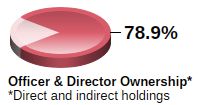

Dominion Lending Centres Inc., formerly Founders Advantage Capital Corp, is a Canada-based mortgage company. The Company operates through two segments: the Core Business Operations segment and the Non-Core Business Asset Management segment. The Core Business Operations segment represents the core operations of the Company. These core operations are the business of mortgage brokerage franchising and mortgage broker data connectivity services across Canada, which consists of the DLC group of companies (the DLC Group). DLC Group consists of three subsidiaries, such as MCC Mortgage Centre Canada Inc., MA Mortgage Architects Inc. and Newton Connectivity Systems Inc. The Non-Core Business Asset Management segment includes its interest in Club16 Limited Partnership (Club16) and Cape Communications Ltd. (Impact) (collectively the Non-Core Assets) and the expenses, assets and liabilities associated with management of the non-core assets, the Sagard credit facility, and public company costs. Dominion Lending Centres Inc. (DLCG) has a high amount of executive buying compared to its small-cap peers in the market over the past three months. According to regulatory filings yesterday, one insider has invested a total amount of $355,950.

Headlines: Jun 23, 2022

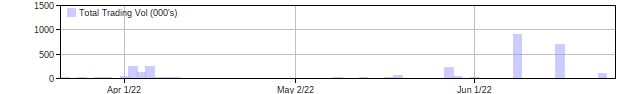

DLCG Insider Holdings Chart

Issuer details as of Jun 23, 2022 2:04 ET

Latest Price

3.39

1 Day Change

0.00%

52 Week High

4.5

52 Week Low

2.81

QMV ($Mils)

157,395,320

Issuer website: https://dlcg.ca/about/