Public market insider buying at ECN Capital (ECN)

Public market insider buying at ECN Capital (T:ECN)

Updated Wednesday Jan 05, 2022 02:56 AM EDT

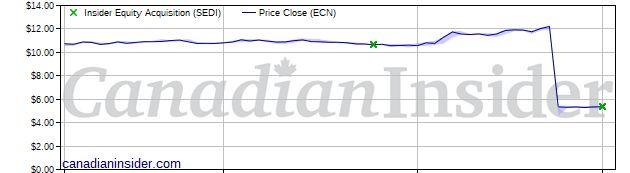

Paul James Stoyan, a Director, acquired 26,000 Common Shares on a direct ownership basis at prices ranging from $5.360 to $5.390 on January 4th, 2022. This represents a $139,682 investment into the company's shares and an account share holdings change of 4.0%.ECN Capital is in the Corporate Financial Services Sub Industry Group under the Financials Sector.

ECN Capital Corp. is a provider of business services to North American based banks, credit unions, life insurance companies, pension funds and investment funds (collectively its Partners). The Company originates, manages and advises on credit assets on behalf of its Partners, mainly unsecured loan portfolios, secured loan portfolios and credit card portfolios. The Company's segments include Triad Financial Services, which includes manufactured home loans; and The Kessler Group, which includes consumer credit card portfolios. The Company's Triad Financial Services segment originates consumer loans for the purchase of manufactured homes throughout the United States and subsequently syndicates and sells these loans to a network of third-party financial institutions. The Kessler Group segment provides capital to fund marketing initiatives on behalf of its Partners.

Headlines: Jan 05, 2022

ECN Insider Holdings Chart

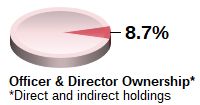

Issuer details as of Jan 05, 2022 2:56 ET

Latest Price

5.35

1 Day Change

0.19%

52 Week High

12.24

52 Week Low

4.6

QMV ($Mils)

1,298,080,569

Issuer website: https://www.ecncapitalcorp.com/