After a dismal 2018, Canadian stocks as tracked by the mid-cap oriented INK Canadian Insider (CIN) Index are off to a happy start in the New Year with the index advancing 1.6% in the first three trading days of 2019. With the experience of last October fresh in our minds when Canadian stocks jumped at the start of the month, only to swoon in the following weeks, we are hesitant to make too much out of the move. However, there are some encouraging signs.

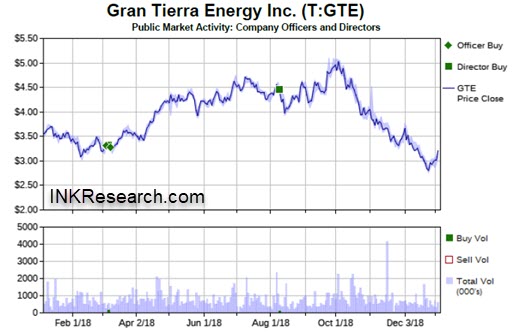

Colombia oil & gas producer Gran Tierra Energy is an early winner in 2019 (click for larger)

Firstly, the INK CIN Index continues to outperform the large-cap S&P/TSX 60 Index which tracks a group of stocks that investors tend to prefer on a relative basis during times of trouble. Secondly, our INK Indicator has put in a peak which would suggest that the December 24th low in stocks is a key support level. Insider sentiment often peaks around key lows. However, it is always a tricky challenge to avoid a head fake while trying to identify a base in stock prices.

Although Friday's Fed rally lifted all boats in the markets, any ensuing consolidation period could be quite volatile as investors sort out who will be the winners and losers in this new wait-and-see Fed environment. As such, sector and stock selection will be key. Below, we summarize where we stand based on our readings with respect to the chances of a durable base having been formed for the top 10 sectors in Canada.

Energy: Base is likely established; risk of a test this month (would be a buying opportunity)

Basic Materials: Base is likely established

Industrials: Base prone to being tested soon

Consumer Cyclicals: Base not firmly established

Consumer Non-Cyclicals: Base established, upside breakout likely to be attempted

Financials (including REITs): Base prone to being tested soon

Healthcare (including cannabis): Base likely established after a false start in December

Technology (including blockchain): Base likely established but more consolidation is also likely (stock selection to dominate)

Telecom: Unclear (stock selection likely to dominate)

Utilities: Unclear (stock selection likely to dominate)

In terms of winning stocks for 2019, so far this year the top 3 performing stocks in the INK CIN Index are Yangarra Resources (Mixed; YGR) +19.1%, Bausch Health (Mostly Sunny; BHC) +12.8%, and Gran Tierra Energy (Mostly Sunny; GTE) +7.7%.

This is an excerpt from the December 19th U.S. Market INK report. The full version was made available to INK Research subscribers and Canadian Insider Club members before the open. INK Edge outlook ranking categories (Sunny, Mostly Sunny, Mixed, Cloudy, Rainy) are designed to identify groups of stocks that have the potential to out- or under-perform the market. However, any individual stock could surprise on the up or downside. As such, outlook categories are not meant to be stock-specific recommendations. For background on our INK Edge outlook, please visit our FAQ #5 at INKResearch.com.

Nike sneakers | Aimé Leon Dore x New Balance 550 'Red' — Ietp